Balancing work, family, and career aspirations is a common challenge for finance professionals. Online degrees in finance provide a potential solution, allowing for flexible learning schedules. However, the lack of in-person interaction can be a drawback for some. Careful consideration of program structure and learning style is essential for success. This guide explores the advantages, challenges, and essential factors to consider when pursuing an online degree in finance.

Toc

- 1. Is an Online Finance Degree Worth It? Exploring the Benefits and Challenges

- 2. Choosing the Right Accredited Online Finance Program

- 3. Specialized Online Degrees in Finance and Accounting

- 4. Related articles 01:

- 5. Understanding the Cost of Online Finance Degrees and Financial Aid Options

- 6. Navigating Career Outcomes with an Online Finance Degree

- 7. Related articles 02:

- 8. Western Governors University and Other Top Online Finance Degree Options

- 9. Accelerated Online Finance Degree Programs: A Faster Path to Success

- 10. Conclusion

Is an Online Finance Degree Worth It? Exploring the Benefits and Challenges

The decision to pursue online degrees in finance often raises the question: “Is an online finance degree worth it?” The answer can vary based on individual circumstances, but there are compelling advantages to these programs. First and foremost, online learning offers unmatched flexibility. Working professionals can tailor their studies around job responsibilities and personal commitments, making it easier to balance multiple obligations.

In terms of career advancement, obtaining an online finance degree can lead to significant benefits. Graduates frequently report increased earning potential and enhanced job satisfaction. According to research, finance professionals with advanced degrees earn an average of 20% more than their counterparts without them. Furthermore, the finance job market is projected to grow by 5% over the next decade, making this an opportune time to invest in education.

However, online learning is not without its challenges. It requires a high level of self-discipline and time management skills. Additionally, some employers may still harbor misconceptions about the value of online degrees compared to traditional ones, although this preference is decreasing. The lack of networking opportunities associated with online programs can also hinder students, as on-campus experiences often facilitate valuable connections in the finance industry. Understanding these challenges can help prospective students prepare for a successful educational journey.

Choosing the Right Accredited Online Finance Program

When selecting an accredited online finance program, it is vital to consider multiple criteria to ensure the program aligns with both your professional goals and personal needs. Begin by verifying the program’s accreditation status through reputable organizations such as the AACSB (Association to Advance Collegiate Schools of Business) or other recognized accrediting bodies. Accreditation ensures the program meets rigorous academic standards and is widely respected by employers.

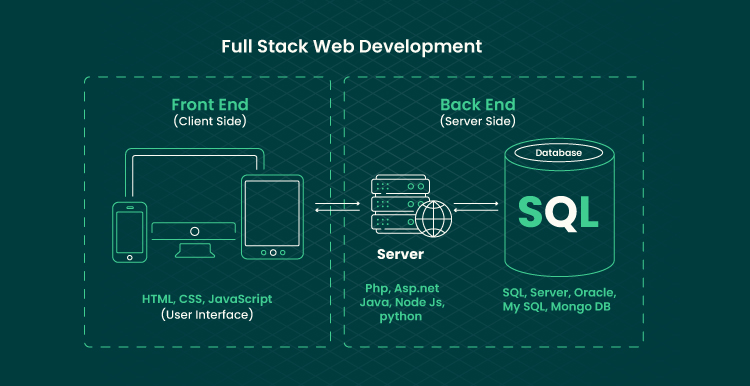

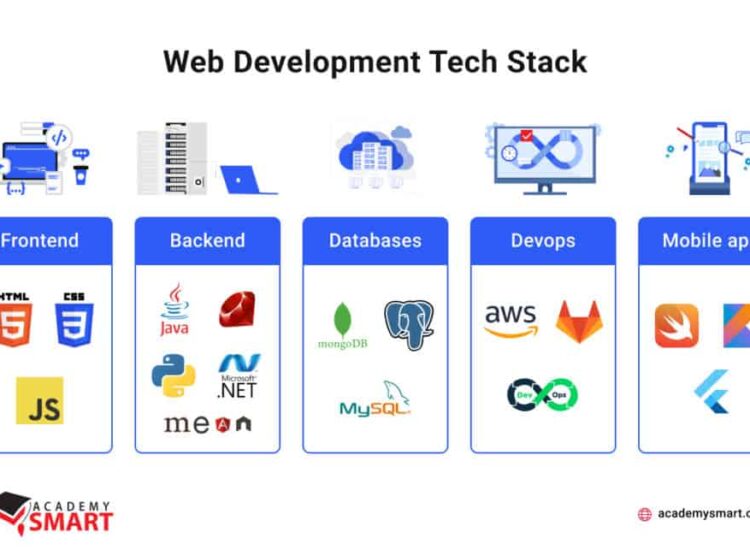

Next, evaluate the curriculum offered by the program. A robust online finance degree should cover essential topics such as financial analysis, investment strategies, risk management, and corporate finance. Additionally, it is beneficial if the curriculum includes courses on emerging areas like fintech, data analytics, or global markets, as these subjects are becoming increasingly relevant in the financial sector.

Consider the level of support provided to online students. Successful programs often offer comprehensive academic resources, such as virtual libraries, tutoring services, and dedicated advisors who can guide students throughout their studies. Career services, like job placement support or internship opportunities, can also be key to translating your degree into tangible career outcomes.

Finally, don’t overlook the importance of flexibility in the program’s structure. Some programs offer asynchronous learning, allowing you to complete coursework on your own schedule, while others may require synchronous interactions. Tailor your choice to your learning style to maximize your chances of success.

Specialized Online Degrees in Finance and Accounting

An online degree in finance and accounting can provide professionals with a comprehensive understanding of both fields, increasing career versatility. This combination opens doors to various specialized career paths, including financial analysis, investment management, auditing, and forensic accounting.

1. https://tech.banktop.vn/mmoga-penn-state-online-courses-your-path-to-career-advancement

2. https://tech.banktop.vn/mmoga-lpn-online-courses-in-florida-your-pathway-to-a-nursing-career

3. https://tech.banktop.vn/mmoga-best-data-science-online-courses-for-career-transformation-in-2024

4. https://tech.banktop.vn/mmoga-online-degrees-in-history-your-path-to-career-advancement

Concentration in Financial Analysis

Graduates with a concentration in financial analysis acquire critical skills sought after in the finance industry. They learn to assess the financial health of organizations and make informed recommendations based on their analyses. Potential employers for these graduates include banks, investment firms, and corporate finance departments.

Investment Management

Investment management programs prepare students for roles that involve managing client portfolios and making investment decisions. This specialization emphasizes portfolio theory, security analysis, and risk management, equipping graduates with the tools needed to navigate the complexities of financial markets.

Auditing and Forensic Accounting

Programs focused on auditing and forensic accounting train students to investigate financial discrepancies and ensure compliance with regulations. Graduates can pursue careers as auditors or forensic accountants, roles that are increasingly vital in today’s regulatory environment.

The Rise of Fintech and its Impact

The increasing importance of fintech in the finance industry has led many online programs to adapt their curricula to include relevant coursework. Topics such as blockchain technology, digital currencies, and artificial intelligence in finance are becoming integral components of finance degrees. Understanding these innovations is essential for graduates who wish to remain competitive in a rapidly evolving job market.

The Growing Demand for Data Analytics Skills

There is a rising demand for data analytics skills in the finance sector, as organizations seek to leverage data for strategic decision-making. Many online finance programs are now integrating data analysis and visualization tools into their curricula, preparing students to analyze market trends and make data-driven decisions.

Understanding the Cost of Online Finance Degrees and Financial Aid Options

The finance degree online cost is a significant consideration for many prospective students. Tuition rates can vary widely between institutions, making it essential to compare costs carefully. While some programs may advertise as the “cheapest online finance degree,” it’s vital to assess the overall value, including educational quality, faculty expertise, and available resources.

When evaluating the cost of online finance degrees, students should look beyond tuition to include additional fees, textbooks, and other expenses. Creating a comparison table of various universities can provide clarity and help prospective students make informed decisions. Furthermore, understanding available financial aid options can alleviate some financial burdens. Scholarships, grants, and employer-sponsored tuition reimbursement programs are often available for working professionals, making higher education more accessible.

Potential for Loan Debt

Prospective students should also be aware of the potential for loan debt when pursuing online degrees in finance. Comparing the total cost of attendance—including fees, books, and living expenses—across different programs can provide a clearer picture of financial implications. Engaging with financial advisors or utilizing online resources to assess long-term return on investment can be beneficial.

Financial Aid and Scholarship Opportunities

Many institutions offer various financial aid options, including federal and state grants, scholarships, and work-study programs. Potential students should also inquire about tuition reimbursement programs offered by employers, which can significantly reduce out-of-pocket expenses. Additionally, some universities provide specific scholarships aimed at students pursuing online degrees in finance, making education more affordable. It’s essential to utilize all available resources and plan financially for the duration of the program to avoid potential financial stressors.

An online degree in finance or accounting can open doors to various career opportunities. Graduates can pursue roles in corporate finance, investment banking, financial planning, or risk management. The skills acquired through specialized concentrations and practical coursework prepare graduates for a competitive job market.

Advancing Your Current Career

Many professionals choose to pursue an online finance degree to advance their current careers. This option allows them to continue working while gaining a higher level of expertise and knowledge in their field. Graduates can apply the skills they learn immediately, making them more valuable employees and increasing opportunities for career growth.

1. https://tech.banktop.vn/mmoga-best-data-science-online-courses-for-career-transformation-in-2024

2. https://tech.banktop.vn/mmoga-penn-state-online-courses-your-path-to-career-advancement

4. https://tech.banktop.vn/mmoga-lpn-online-courses-in-florida-your-pathway-to-a-nursing-career

5. https://tech.banktop.vn/mmoga-online-degrees-in-history-your-path-to-career-advancement

Transitioning into a New Career

For those looking to switch careers or enter the finance industry, an online degree is also a viable option. Online programs provide flexibility for individuals who may be constrained by work or personal commitments but still wish to pursue further education. The specialized concentrations offered in online finance degrees allow students to tailor their education to align with specific career goals.

Western Governors University and Other Top Online Finance Degree Options

Western Governors University (WGU) is a standout option in the realm of online finance education. Known for its competency-based learning approach, WGU allows students to progress through coursework at their own pace, making it an ideal choice for busy professionals. This unique structure empowers students to focus on mastering material rather than simply completing assignments.

When comparing WGU with other reputable online programs, it’s essential to consider factors such as program structure, accreditation status, and career support services. Understanding these elements will enable prospective students to select the program that best meets their needs and career aspirations.

Notable Programs in Florida and Texas

The availability of accredited online finance degrees varies by region, with states like Florida and Texas offering robust programs tailored to local job markets. Florida is known for its growing financial services sector, presenting numerous opportunities for graduates. Meanwhile, Texas boasts a diverse economy with significant demand for finance professionals across various industries. Understanding the specific advantages of programs in these states can help students make informed decisions about their educational paths.

Accelerated Online Finance Degree Programs: A Faster Path to Success

For professionals eager to complete their education quickly, accelerated online finance degree programs present an attractive option. These programs typically condense coursework, allowing students to graduate in a shorter time frame while still receiving a comprehensive education.

Benefits of Accelerated Programs

Accelerated programs are specially designed with the needs of busy professionals in mind, offering a condensed yet rigorous curriculum that allows students to achieve their educational goals in significantly less time compared to traditional programs. This efficiency is particularly appealing to individuals who want to make a swift career transition, advance in their current field, or gain new skills without committing to a multi-year program. Beyond saving time, these programs often focus on practical, real-world applications, enabling students to quickly apply what they’ve learned to their careers. However, the fast-paced nature of these programs demands strong organizational skills and the ability to adapt quickly, as coursework can be challenging and time-intensive.

Time Management Tips

To excel in an accelerated program, students need to master effective time management strategies, as balancing academics with work and personal responsibilities is key. Start by setting a consistent study schedule that aligns with your daily routine, carving out dedicated time blocks for coursework and assignments. Prioritize tasks by focusing on deadlines and breaking down larger projects into smaller, manageable steps. Utilizing online resources, such as time management tools, libraries, and forums, can greatly enhance productivity. Additionally, building a support network is crucial—maintaining regular communication with professors and classmates not only fosters collaboration but also provides valuable insights and guidance. Many programs also offer access to advisors or mentorship opportunities to help students navigate challenges and stay on track. By staying organized and proactive, students can make the most out of their accelerated learning experience and achieve their goals efficiently.

Conclusion

Pursuing online degrees in finance is a strategic investment in your future, particularly for working professionals aiming for career growth and enhanced earning potential. By carefully considering various factors outlined in this guide—such as accreditation, program costs, specialization options, and current trends in the finance industry—you can make an informed decision that aligns with your professional goals.

Additionally, exploring alternative learning paths like professional certifications (e.g., CFA, CAIA) can offer further value for career advancement. Begin your research today by exploring the universities and programs mentioned, including Western Governors University and options in Florida and Texas, and take the next step toward a rewarding career in finance.